Our thanks to exchangeright.com for the information contained in this article

A 721 Exchange allows an investor to exchange Delaware Statutory Trusts (DSTs) and other real property ownership into Operating Partnership Units of a REIT on a tax-deferred basis.

The 721 strategy is often appropriate for investors who are seeking broader diversification, stable income, added liquidity options, passive management, and appreciation potential.

§ 721 of the Internal Revenue Code was instituted in 1954, giving 721 exchanges a long and established history of use in business combinations and real estate transactions. § 721 provides that a transfer of property to a partnership does not result in income or loss recognition to the transferor. So when contributing one’s real estate to an operating partnership of a REIT no gain is realized.

“No gain or loss shall be recognized to a partnership or to any of its partners in the case of a contribution of property to the partnership in exchange for an interest in the partnership.

Using a 721 exchange to contribute your property or DST

interest into a REIT in exchange for units in the REIT’s

operating partnership can effectively defer all capital

gains and depreciation recapture taxes, preserving 100%

of your capital for reinvestment into large, diversified

portfolios of institutional commercial real estate that can

generate stable passive income and returns

A DST investor may utilize the 721 exchange to transition into operating partnership units of a REIT that acquires the DST’s portfolio. This strategy requires the DST investor to seek DSTs whose investment philosophy and acquisition criteria meet that of the targeting acquiring REIT. Timelines for transferring from DSTs to 721 Operating units should be discussed with the sponsor before investing.

REIT ownership entitles each investor to their portion of the income, depreciation and tax benefits, and the performance of the underlying real estate. REITs can specialize in a specific asset class or diversify their holdings across multiple classes. While REITs can provide unique income and tax benefits, it is important to remember that the quality of the real estate portfolio and its asset management are the primary factors determining whether a REIT can protect investor capital and provide stable returns.

Contributing a DST interest or property to a REIT may allow an investor to participate in a larger portfolio of passive, income-producing real estate, potentially increasing diversification by location, tenant, industry, lease term, and debt laddering.

REIT sponsors are responsible for all acquisitions, dispositions, management, accounting, reporting, and investor distributions. They are structured to provide investors with passive cash flow and return potential.

REITs are able to make property acquisitions on an ongoing basis, and execute acquisitions or mergers with other real estate businesses, allowing the 721 investors to participate in expansion and growth opportunities.

Most non-traded REITs feature liquidity provisions for the 721 investor after an initial minimum hold period. Liquidity provisions allow the investor to convert all or part of their ownership units to cash, a provision that is not available inside a DST.

721 investors transfer their DST’s tax basis to the REIT and continue to receive their depreciation benefits. The REIT may also be able to pass additional accelerated depreciation benefits to the 721 investor from new asset purchases.

Operating units in a REIT carry risks associated with real estate, can be illiquid or have limited liquidity, and performance is not guaranteed. 721 investors should complete a careful analysis of the risks and benefits of any REIT before making an investment decision.

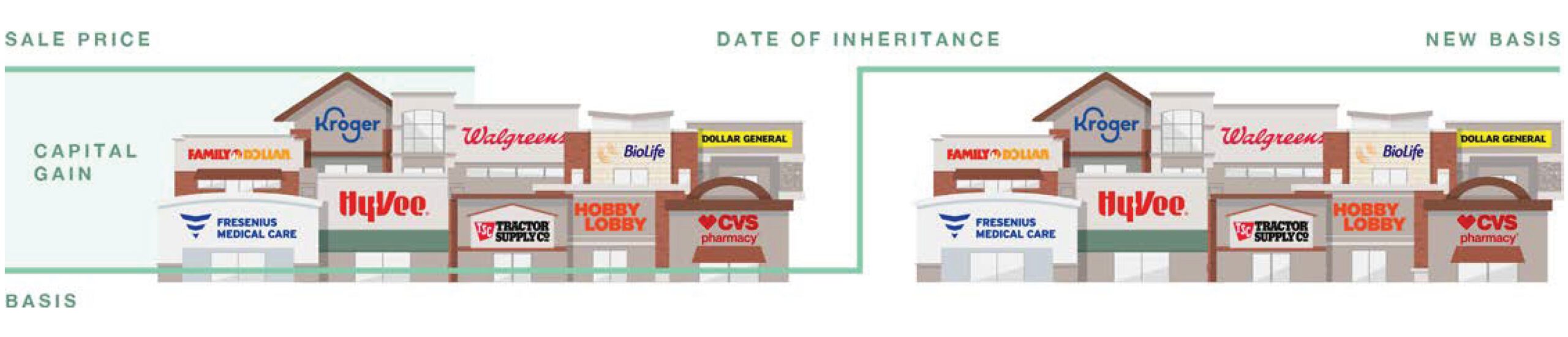

721 REIT operating units, similar to DSTs or other real property assets, receive a step-up in tax basis to current market value upon the death of the owner. Heirs inheriting the REIT units may sell them utilizing their stepped-up tax basis, often either minimizing or eliminating any capital gains.

What is the REIT’s current AFFO, and what has it been historically? Has it provided consistent dividend coverage? If the REIT’s dividend coverage ratio is not adequate, its managers may be diluting the REIT’s value by using investor capital or debt to fund investor distributions, which may result in a future disruption to dividends and/or a loss of investor principal.

Make sure that REIT managers’ personal interests are aligned with investors’ interests. How much are the managers co-invested in the REIT? Is the managers’ fee structure designed to incentivize growing the value of the REIT over time and making acquisitions that benefit investors?

Acquiring REITs with strong Debt Service Coverage Ratios and balance sheets with plenty of liquid assets can flexibly access additional sources of capital, increase diversification through acquisitions, and meet investor redemption expectations.

To take full advantage of the stability of commercial real estate, make sure the acquiring REIT has diversified assets that are designed to bridge cycles, weather different macroeconomic climates, and minimize the effects of market volatility. A REIT’s managers should have a clear macroeconomic perspective and should carefully design their REIT with that in mind.

Make sure the acquiring REIT is not significantly increasing your leverage. Using high leverage can put pressure on a REIT to refinance in the future, leaves little margin of safety, and risks cash flow swings or reduction in available liquidity. A 721 investor may find that the acquiring REIT utilizes slightly lower leverage than their DST, possibly reducing their risk.

The REIT simplifies and reduces the tax reporting process for 721 investors by annually computing and tracking 721 investor depreciation and by filing composite state tax returns which reduce 721 investors’ need for separately filing in multiple states.

The acquiring REIT should have a disciplined acquisition strategy, ideally with a long pipeline of acquisitions pre-arranged for strategic growth. If a REIT is raising money too quickly without an existing pipeline of identified acquisitions, they may be motivated or forced to make poor acquisitions to place equity

The length and laddering of lease and debt terms are often overlooked aspects of portfolio construction. If a REIT’s lease or debt maturities are concentrated in a given year, long-term success may overly depend on the economic climate within one particular time window. The acquiring REIT should have laddered lease and debt terms, as well as a high Weight Average Lease Term (“WALT”) and a high Weight Average Debt Term (“WADT”) to bridge economic cycles.

If a REIT is too reliant on variable-rate debt or has mismatched timing for debt maturity and lease expirations, it can be sensitive to interest rate risks, where the cost of its debt increases while its revenue stays fixed. The REIT should have well-coordinated lease and debt rollovers so that its assets and liabilities stay aligned in the long-term.

Confirm that there is an alignment of goals between you and the REIT’s acquisition strategy. If your goal is consistent passive income, determine that the REIT is designed to minimize risk and provide steady distributions instead of focusing primarily on speculative assets that may be more sensitive to economic cycles.

This information is intended to highlight the typical objectives, benefits, and characteristics found in REIT structures and may vary for individual REITs. This is not a recommendation of any specific REIT or investment offering. Potential benefits do not guarantee performance. Investors should read any REIT offering in its entirety and consult their tax and/or legal counsel before considering an investment.

Real estate brokerage services are provided through Turner Investment Corporation. Securities are offered through McDermott Investment Services, LLC a Registered Broker/Dealer, Member FINRA, SIPC and MSRB. McDermott Investment Services, LLC and Turner Investment Corporation are separate entities.

Turner Investment Corporation and McDermott Investment Services are neither CPAs nor Attorneys and therefore cannot provide tax or legal advice. Nothing contained herein should be construed as tax or legal advice which should be provided by your own tax or legal advisor.

Properties and Investments shown may be pending approval during the Firm’s Due Diligence Process or may otherwise be unavailable. The information provided is neither an offer to sell nor a solicitation to buy an interest in any property or investment, which may only be done after delivery of a Private Placement Memorandum and client suitability is reviewed & approved.

Projected income or returns are only projections and are entirely dependent on the performance of the underlying property(s) and sponsor. Investment real estate, including securitized real estate, comes with substantial risks, including but not limited to; the absence of guaranteed income; lack of liquidity; the risks of owning, managing, operating and leasing properties; possible conflicts of interest with managers and affiliated persons or entities; the risks associated with leverage; tax risks, including possible changes in tax law; declining markets and challenging economic conditions; on- going fees; and known or unknown regulatory challenges.

Finally, it must be understood that the ultimate risk of investing in real estate could include the total loss of your principal investment.

Stay up to date with the latest tips and insights on 1031 exchanges, DST properties, and more!